Bankruptcies: A victim of the corona crisis?

The sales plunge triggered by the corona crisis has shoved many companies into financial distress. However, the number of German companies filing for insolvency proceedings (bankruptcy) fell astonishingly during the pandemic. This is revealed by a newly compiled insolvency database of the TRR 266. However, “the fewer the better” does not apply in this case. Find out what this paradox is about, why restarting the economy after the pandemic could be difficult, and why bankruptcy research is so important.

Bankruptcies have an unjustified bad reputation. In fact, they are a central part of business environment and enable claims against financially distressed companies to be settled in a coordinated manner. Insolvency law aims to remove non-viable companies from the market in a regulated manner–and thus provides space for creating new companies. It also helps can- didates for restructuring to make a fresh start. In this way, insolvency law strengthens confidence in the business environ- ment–in good times and in bad times–and consequently in the economy as a whole.

Fewer bankruptcies due to suspension of the obligation to file for insolvency

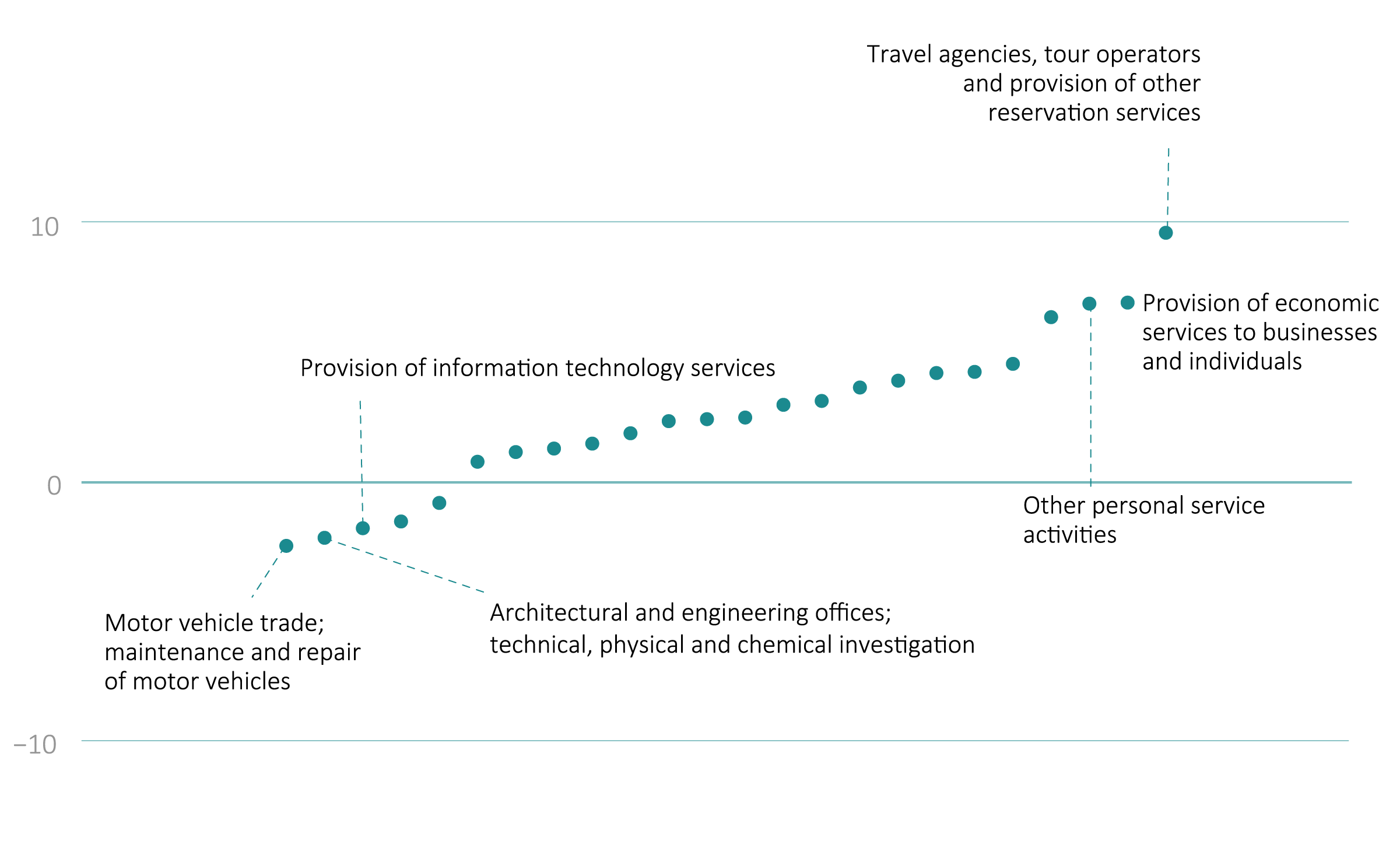

The number of bankruptcies is already an important indicator of the business activity in normal economic conditions. This makes it all the more important to maintain an overview inthe times of crisis. For this reason, we have compiled a new database with daily updates of corporate filings for insolvency proceedings and made it publicly available. While the corona crisis has left many companies struggling to survive, corporate bankruptcies fell significantly during the pandemic year (Figure 1). The main reason is obvious: the obligation to file for the opening of insolvency proceeding was temporarily suspended on March 27, 2020, with retroactive effect as of March 1, 2020 (see info box below). This new law aimed to relieve companies, which were experiencing financial distress as the result of the corona crisis, from the obligation to file.

Figure 1: Bankruptcy gap in the pandemic year

Daily corporate insolvency filings in Germany before and after the corona-related suspension of the obligation to file for insolvency.

Upsurge of insolvencies in hard-hit industries

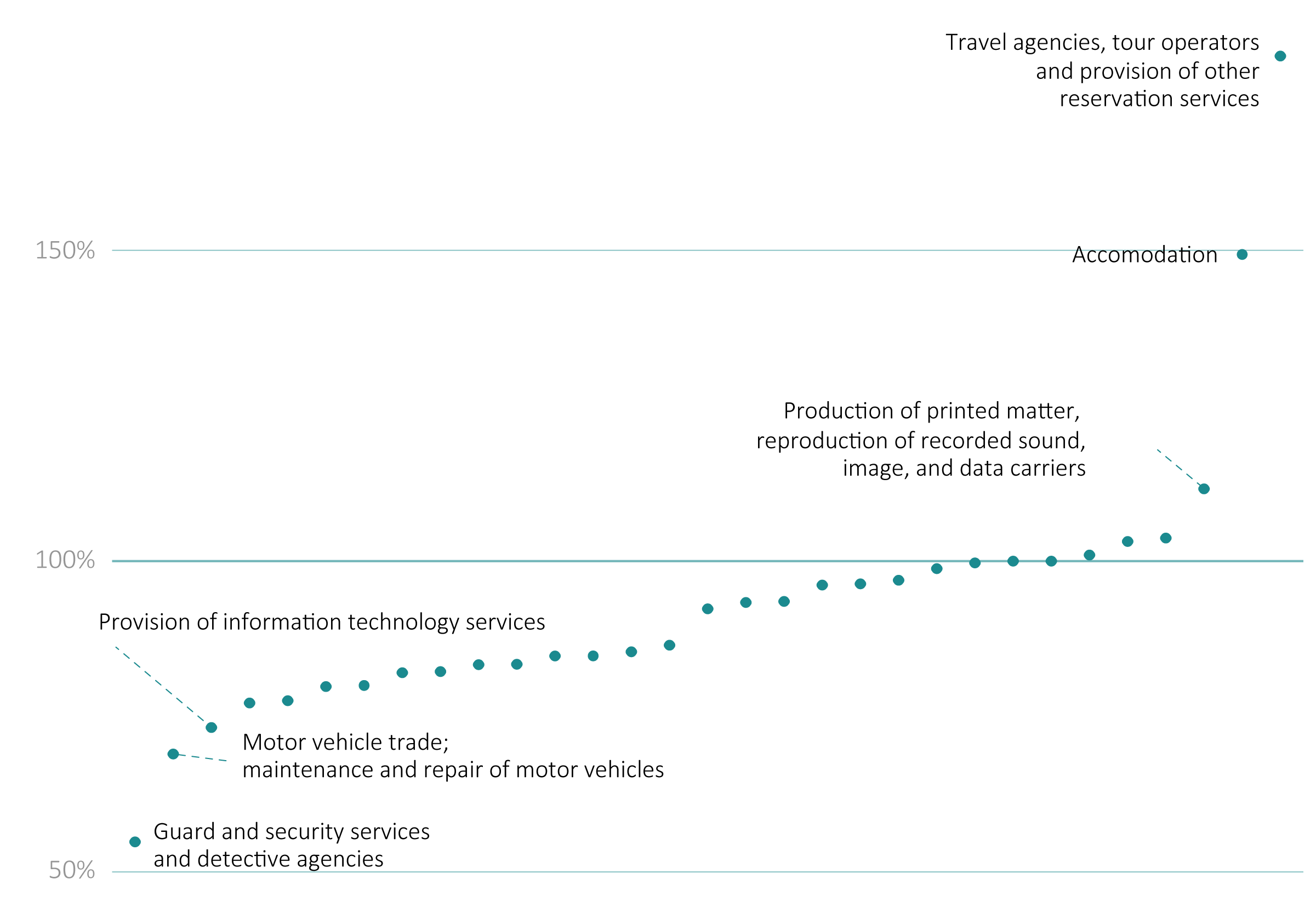

That was the plan. A closer look reveals that insolvency filings have developed differently across industries. As our data shows (Figure 2), the number of insolvency filings fell particularly in industries that were comparatively less affected by the pandemic. For example, the industry sector of automotive repair shops demonstrates a decline in the number of insolvency filings of more than 30% compared to the pre-pandemic year. The decline is somewhat surprising, as the suspension of the obligation to file for insolvency is formally limited to cases where the financial distress was triggered by the effects of the pandemic. In contrast, in industries that were heavily affected by the pandemic, insolvency filings have risen considerably despite the law change. In the industry sector of travel agencies and tour operators, the increase in insolvencies exceeds 100%. Clearly, the number of insolvency filings in most affected sectors would have been even higher without the suspension.

Figure 2: Bankruptcy gap across industries

Corporate insolvency filings 2nd quarter 2020 to 1st quarter 2021 as a percentage of the previous year.

Companies with better liquidity file for insolvency

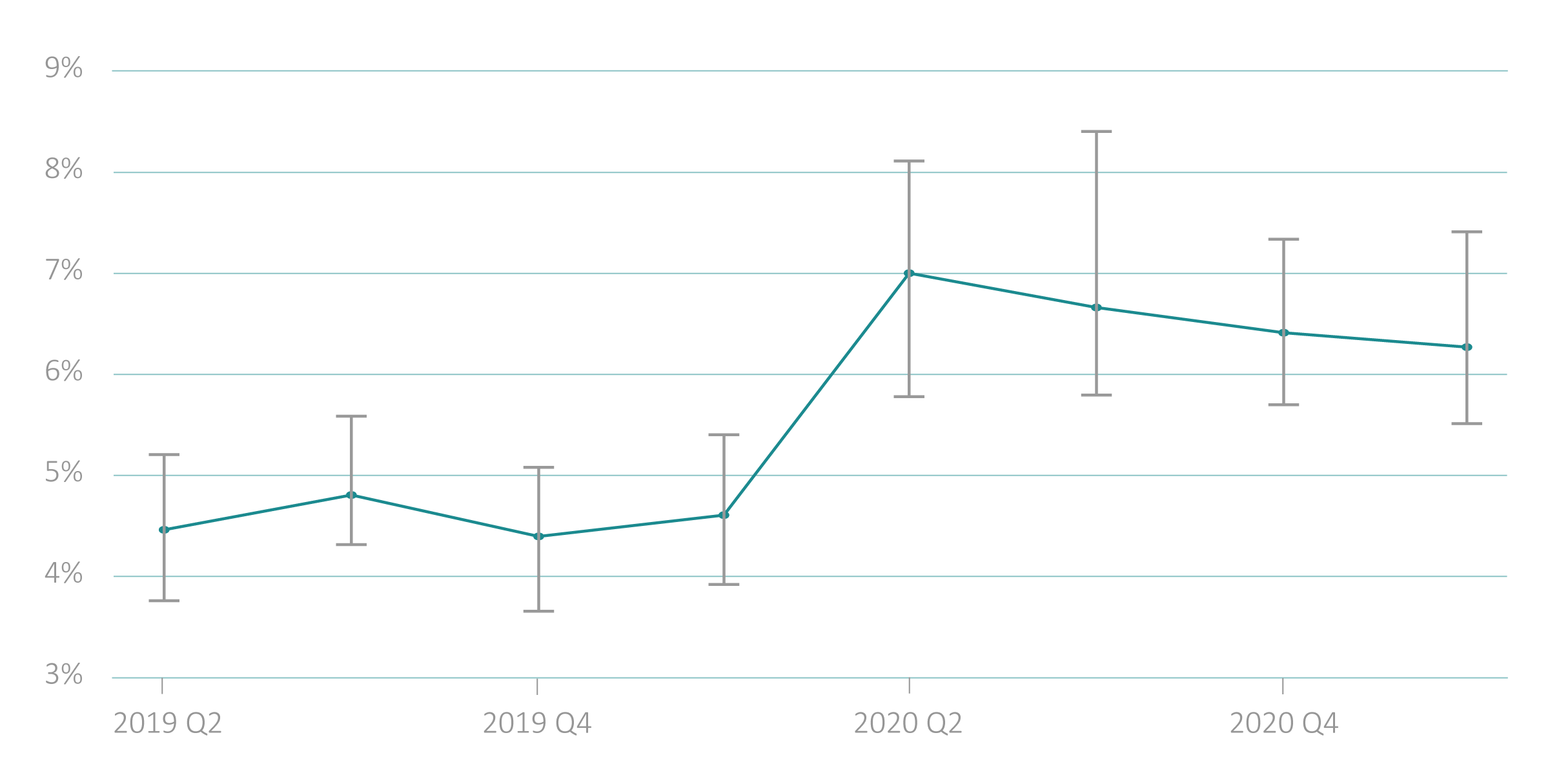

We check whether companies filing for insolvency proceedings in the pandemic year systematically differ from companies filing in the year before. We compare their liquidity ratio calculated from the last available balance sheet. If the new law relieved companies from filing for insolvency proceedings only when the reasons are based on the consequences of the pandemic then we would expect comparable liquidity ratios before and during the crisis. However, this is not the case. The median liquidity ratio of companies filing for insolvency in the first year of the pandemic is higher (Figure 3). This indicates that despite the suspension, some of the companies had to file for insolvency proceedings because of insufficient prospects of eliminating the reason for insolvency.

We also compare the liquidity ratio of companies filing for insolvency during the crisis to those filing in the year before, industry by industry (Figure 4). In very few industry sectors, the liquidity ratio is lower in the crisis year than in the year before. First, this implies that the companies filing for insolvency during the crisis were primarily those that were exposed to particularly severe liquidity shocks. Second, peer companies from these industry sectors that were actually at risk of insolvency did not file for insolvency due to the suspension.

Figure 3: Liquidity of insolvent companies

Median and 95% confidence interval of liquidity ratio (liquid funds + receivables relative to total assets) per quarter.

Figure 4: Liquidity difference of insolvent companies

Difference in liquidity ratio (percentage points of total assets) of insolvent companies before and after the pandemic.

A wave of bankruptcies looms

Our data points to a key problem which could make it more difficult to restart the economy once the pandemic is over. It is quite possible that many inherently illiquid or overindebted companies refrained from filing for insolvency proceedings last year. This led to rise of so-called “zombie companies” which are only “alive” on paper. “Zombie companies” are dangerous because they can “infect” healthy companies they do business with and thus pose a threat to the economy as a whole.

So far, the amendments to the suspension of the obligation to file for insolvency at the beginning of this year have not led to higher number of insolvency filings in industries which are less affected by the pandemic. A wave of bankruptcies that will pose major challenges to the economy is evidently brewing. Moreover, the fear exists that the newly emerged “zombie companies” could diminish confidence in intercompany trade.

The size of the bankruptcy wave is difficult to predict. Even a conservative estimate based on the insolvency behavior from the previous year results in a gap of about 1,400 corporate insolvency filings. This represents about 10% of total filings. Thus, it is time to face the problem. We hope that the database of the TRR 266 can make the current insolvency situation more transparent for both researchers and corporate practice.

Download the report here.

More Information

The data are based on the official notices published by the insolvency courts in Germany on the website https://www.insolvenzbekanntmachungen.de. We only record applications for corporate insolvencies that are published either in the commercial register, the register of cooperatives or the register of associations. Companies are assigned to industries on the basis of the Bureau van Dijk Orbis database. For about 85% of the companies we were able to determine the industry.

To enable researchers and interested public an assessment of the potential bankruptcy wave and to promote bankruptcy research in Germany, the “B02: Private Firm Transparency” project, together with the Open Science Data Center of our research network, has compiled an extensive database of corporate insolvency filings. It contains daily updates of corporate insolvency proceedings supervised by German insolvency courts. The first insight is available at https://www.accounting-for-transparency.de/insol. We are currently preparing more detailed access to the data for research purposes. This includes a link of individual insolvency cases to other company data and access to the documents published by insolvency courts.

Law on the Temporary Suspension of the Obligation to File an Insolvency Petition and on the Limited Liability of Executive Bodies in the Event of Insolvency Caused by the COVID-19 Pandemic (COVID-19 Insolvency Suspension Act-COVInsAG).

§1 Par. 1: The obligation to file an insolvency petition is suspended until September 30, 2020. This does not apply if the reason for a company‘s insolvency was not triggered by the COVID-19 pandemic or if there are insufficient prospects of eliminating the reason for insolvency. If the company was not insolvent on 31 December 2019, it is presumed that its insolvency was triggered by the effects of the COVID-19 pandemic and that there are prospects to eliminate any reason for insolvency.

§1 Par. 2: From October 1, 2020 to December 31, 2020, the suspension only applied for companies which were over-indebted without being illiquid.

§1 Par. 3: From January 1, 2021 to April 30, 2021, only companies, which had applied for financial assistance under state aid programs in the period from November 1, 2020 to February 28, 2021 (or due to legal or factual reasons were unable to do so), were able to benefit from the suspension.

Responses