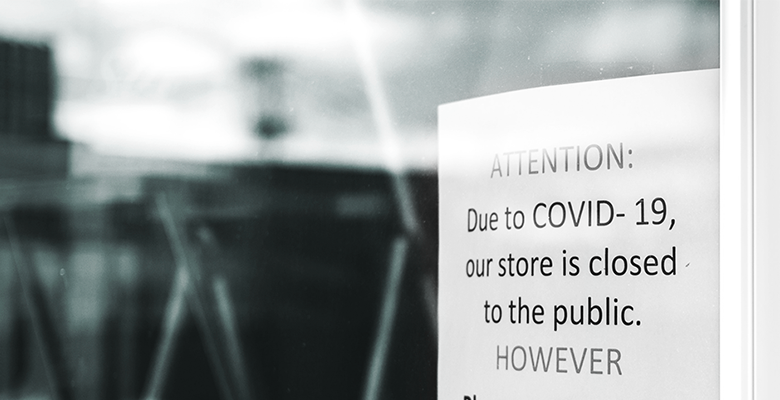

COVID-19: TRR 266 Research Insights

Addressing the economic challenges caused by COVID-19

How can we minimize long-term damage to the economic system caused by COVID-19? A question that currently occupies the minds of our politicians, policymakers, CEOs, professionals and citizens. A question to which there is not just one answer, but that needs to be broken down into sub questions and requires careful reflection from different perspectives. We therefore asked our researchers – a group of more than 100 researchers who specialize in taxation and accounting and have different methodological backgrounds – to share their thoughts regarding this burning question. The result: a collection of articles based on current and previous research, ranging from business- to country-level and from economic consequences to standard setting. We hope this collection will offer helpful insights for businesses and politics, and helps the world address these challenging times.

Blogs

Managing the new normal: How has working from home changed management strategies during the coronavirus pandemic?

The COVID-19 pandemic has taken companies into uncharted territory: everyone is working from home. Online meetings suddenly became the norm. But how do you manage a company when no one is on site and everything is digital? TRR 266 researchers Hoa Ho, Christian Hofmann and Nina Schwaiger from LMU…

Read moreBankruptcies: A victim of the corona crisis?

The number of German companies filing for insolvency proceedings (bankruptcy) fell astonishingly during the pandemic. This is revealed by a newly compiled insolvency database.

Read moreTax relief as corona government aid – Findings from TRR 266 research

Deborah Schanz recently gave her opinion as a scientific expert in the Finance Committee of the German Parliament (Bundestag) on the 3rd Corona Tax Relief Act and made suggestions for improvements.

Read moreGerman Business Panel pilot study: Shedding light on how corona aid affected firms in Germany

How are firms affected by the corona crisis? Is the German governments’ support effective? The German Business Panel recently conducted its first survey and received responses of more than 9.500 firms about the effectiveness of Germany’s corona aid.

Read moreSurvey: Administrative burden and tax relief in the corona crisis

How are the temporary tax relief measures perceived by German firms? How do firms estimate their tax administrative burden?

Read moreOpen Science in corona times

In response to the COVID-19 pandemic three new projects have been initiated by the Open Science Data Center of the TRR 266.

Read moreEvidence-informed accounting standard setting – lessons from corona

How can researchers and standard setters address validity challenges as they work towards more evidence-informed standard setting?

Read moreCOVID-19: combat liquidity shortages with immediate loss carryback

Immediate loss carryback is an important measure to provide affected companies with short-term liquidity.

Read morePublications

The Covid-19 Pandemic and Management Controls

Firm-level Exposure to Epidemic Diseases: Covid-19, SARS, and H1N1

No. 107: The Covid-19 pandemic and management controls

Kostenstruktur und Unternehmensflexibilität in der COVID-19-Krise

No. 71: Working from home and management controls

Wiedereinführung der Vermögensteuer – Eine ökonomische Analyse

No. 59: The epidemiology of tax avoidance narratives

Die Bedeutung der Kostenstruktur für die Effektivität von Staatshilfen

Disclosures of expected credit losses around the beginning of a crisis: Evidence from European banks during the COVID-19 pandemic

Bankruptcies: a victim of the corona crisis?

No. 46: The German Business Panel: Evidence on Accounting and Business Taxation

No. 25: COVID-19 and investor behavior

No. 24: Firm-level exposure to epidemic diseases: Covid-19, SARS, and H1N1

German Business Panel Reports

Videos

How the crisis increases the need for corporate transparency: Interview with researcher Dirk Simons (Video in German with English subtitles)

Nina Schwaiger talks about management controls and how working from home changed management strategies during the Covid-19 pandemic.

In this explanatory video you can learn more about why transparency is important in regards to Covid-19, other crises like the Ukraine war, sustainability, tax systems and disclosure regulations.

In the News

More about Covid-19 and other current crises