Data

We are committed to the principles of Open Science and one of our goals is to make our research publicly available and understandable for everyone. This page gives you an overview of our interactive data visualizations, databases, github repositories and replication files to our research.

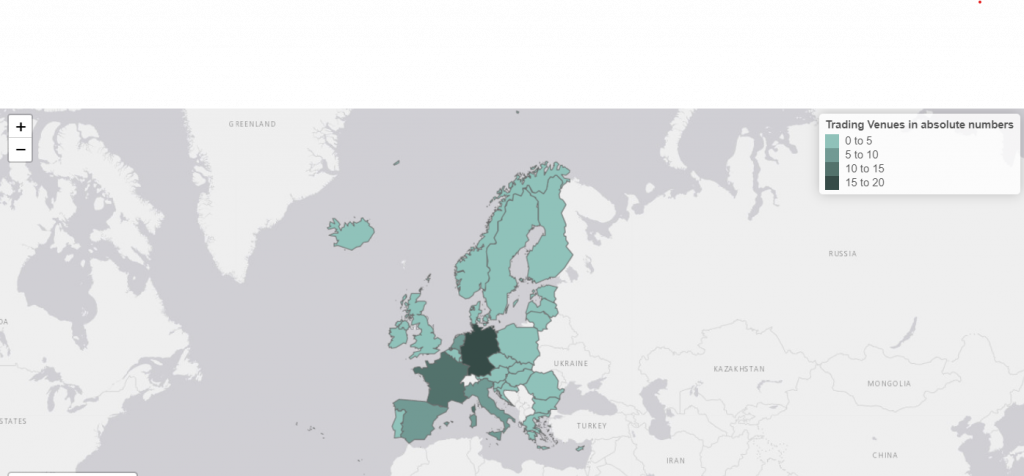

The European Bond Market Database(EBMD)

Bond financing is highly relevant for corporations but data on the European market is scarce. The EBMD is a comprehensive database of non-financial corporate bond listings in Europe. You can find data on when, where, for how long and by whom, bonds are listed on European exchanges. Further, data on bond characteristics and the issuer is available that allow for micro-level analysis of how recent regulatory changes and economic events affect the European bond market.

Sustainability Reporting Navigator

Sustainability is increasingly becoming the focus of many companies. To contribute to an ecologically sustainable economy, we developed the Sustainability Reporting Navigator: it compares climate change reporting requirements and practices in the DAX with firm’s own readiness to standards proposed by ISSB, EFRAG and GRI. At this point, you can see our platform as the first access to the readiness of the largest German companies. We are still extending the prototype step by step and encourage and welcome any feedback. If you are interested in having a first look, head over to the website.

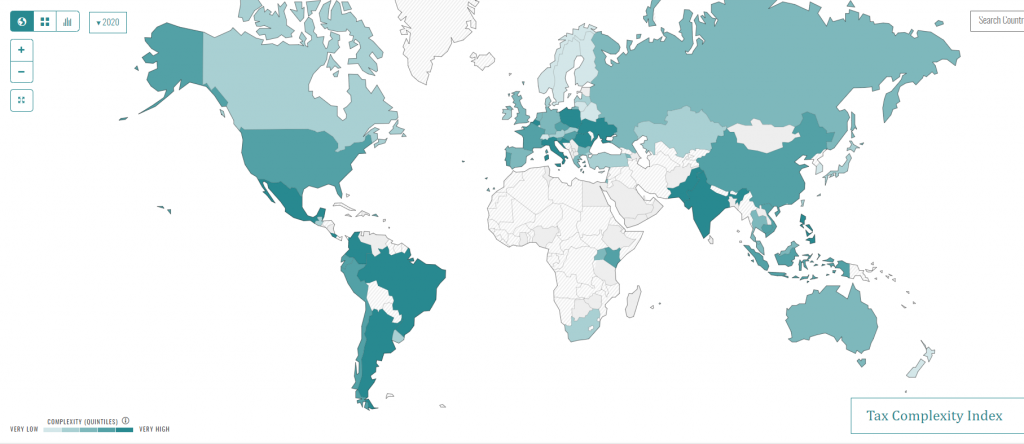

Tax Complexity Index

We developed the Tax Complexity Index: it measures the complexity of a country’s corporate income tax system as faced by multinational corporations. The data is publicly available on our interactive website. The website allows interested parties, such as policymakers, practitioners and researchers, to learn more about tax complexity in different countries and to compare the overall Tax Complexity Index of countries from 2016 to 2022.

You can also find comprehensive information about our latest research findings on our designated webpage about the Global MNC Tax Complexity Survey.

Climate Change Lab

We study corporations and (capital) markets and use the tools developed by researchers in these domains to understand how climate change affects the corporate world and how firms and markets impact on climate change. We have developed an interactive app which shows and plots country-level and industry-level climate change measures.

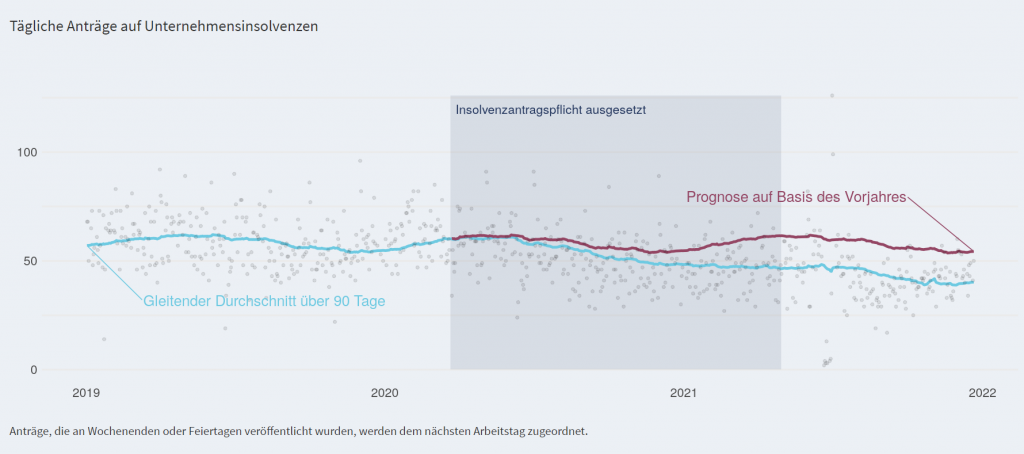

The insol Database

Insolvencies are a daily occurence, yet little data is available on the topic. We have created an interactive database. Here you will find data on the current status of corporate insolvencies filed in Germany. You can have a look at different time periods, different time periods, different industries and specific regions.

German Business Panel

The „GBP-Monitor“ provides data on firm decision makers’ views on timely and topical issues as well as expectations and perceptions about key business and policy trends with a focus on corporate transparency. It is published on a monthly basis. The underlying data can be downloaded on their website (in German).

Firm-Level Risk Data

On this website we aggregate firm-level measures of exposure, risk, and sentiment constructed using textual analysis of quarterly earnings conference calls held by more than 11,000 listed firms in 81 countries.

Firm-level political risk: measurement and effects

No. 24: Firm-level exposure to epidemic diseases: Covid-19, SARS, and H1N1

Private Firm Accounting Database

This database is the online extension to the paper Private Firm Accounting: The European Reporting Environment, Data and Research Perspectives.

Private firm accounting: The European reporting environment, data and research perspectives

Github repositories

The Usefulness of Financial Accounting Information: Evidence from the Field

The public github repository is available on the data of the paper except for the interview data.

The usefulness of financial accounting information: Evidence from the field

Tax Complexity Survey in German Tax Administrations

In 2018/2019, we surveyed employees of the German tax administration on their perception of the tax complexity of the German tax code and framework. The results are publicly available and provide valuable views on potential areas of simplification and tax reforms in an increasingly complex environment.

Effective Inheritance Tax Allowance

The German inheritance and gift tax allowance is nominally 400,000 euros (per child) when assets are transferred to the next generation. This allowance can be claimed every ten years, so its effective amount depends on life expectancy. We create transparency by calculating the effective amount of this allowance depending on age, gender, interest rate and growth rate of the assets to be transferred.

Der effektive Wert des erbschaftsteuerlichen Freibetrags

Tax knowledge diffusion via strategic alliances

We publish code for Stata and R in addition to logfiles, tables, and visualizations of the analyses. Not only can readers utilize the repository to evaluate subjective design choices that are inherent to our study but our code can also serve as template for analyses of the underlying databases Compustat and SDC.

Asset Reclassifications and Bank Recapitalization During the Financial Crisis

We examine the introduction of the reclassification option for financial assets during the 2008 financial crisis and study the position of accrual-based options in the pecking order of banks’ recapitalization measures.