Global MNC Tax Complexity Survey

New regulations, digitalization and global tax competition: Global tax systems are constantly facing new challenges. These developments have a significant impact on how complex tax systems are. In recent years, multinational corporations (MNCs) are dealing with increasing levels of tax complexity, making it an important aspect to consider. Our 2022 Global MNC Tax Complexity survey has once again shown: Tax complexity remains at high levels. So what does that mean for MNCs? Check our results!

What is Tax Complexity?

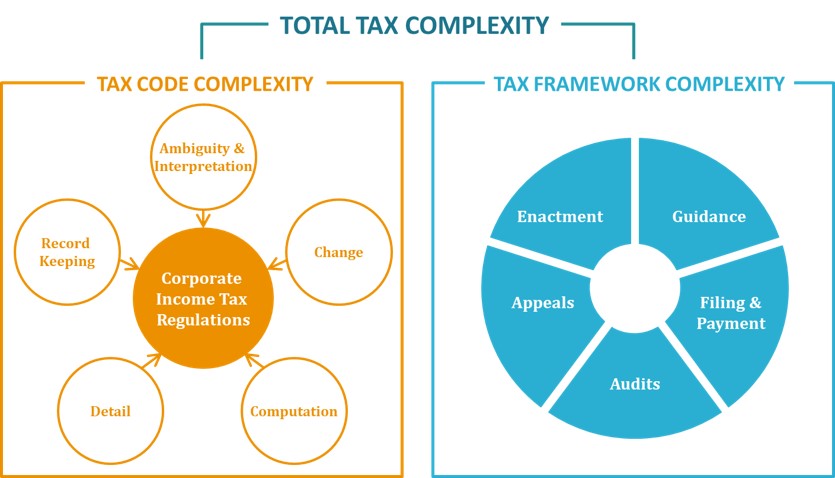

We understand tax complexity to be a feature of the tax system that is characterized by two sub-constructs:

Tax code complexity describes the difficulty of reading, understanding and complying with tax regulations that are affected by five complexity drivers. Therefore, we identified 15 internationally comparable tax regulations serving as dimensions for tax code complexity.

Tax framework complexity describes the complexity that arises from the legislative and administrative processes and features within a tax system and is measured in five dimensions.

Source: Intertax, Volume 46, Issue 8/9 (2018), p. 668

About the survey

We started the Global MNC Tax Complexity Survey in 2016 and conduct the online study biennially. The aim of our survey is to collect information about the drivers of tax complexity across countries and over time.

Method

In our past surveys we received responses from up to 1,000 tax consultants from up to 110 countries. Our study is conducted through an online survey of local tax consultants around the world who work with MNCs. We share the link to our survey via 16 international tax services networks and firms. Then, we aggregate the individual responses at country level.

Assessment

We asked the respondents for their perceived tax complexity for MNCs in their respective countries on the base of the corporate income tax system applicable in the respective year.

Respondents

Our sample consists of highly skilled tax consultants. The majority occupy leading positions in tax services firms, have worked in the field of taxation for at least a decade, and have a master’s degree or higher. On average, the respondents spend more than 60% of their total working time on MNC tax issues.

You can find detailed information about the Tax Complexity Index in the publication “The Tax Complexity Index – A survey-based country measure of tax code and framework complexity“.

2022 Survey Results

Overall Tax Complexity

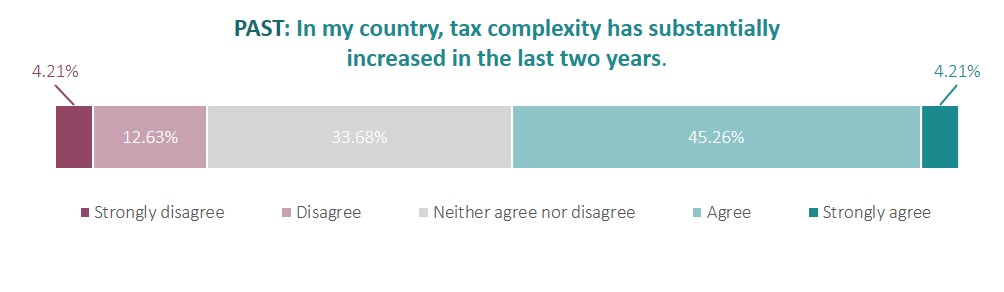

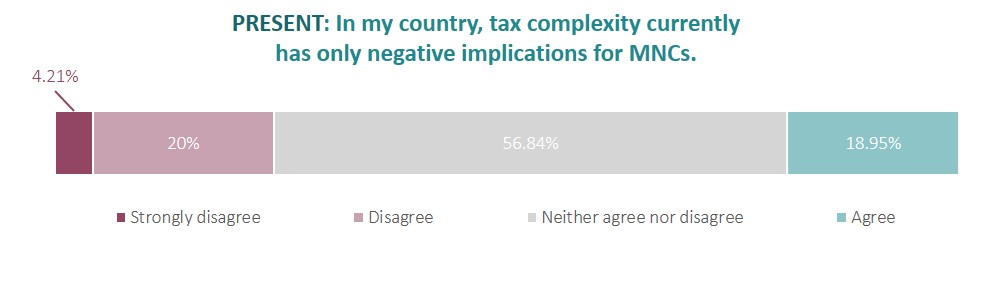

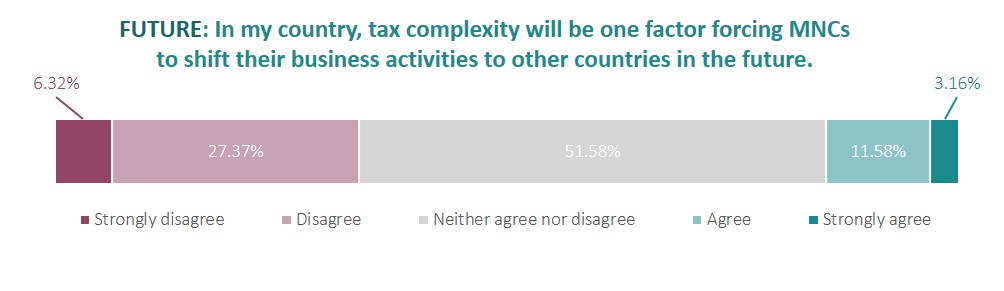

As a first step, participants had to evaluate the relevance of tax complexity in their country in the past, present, and future:

In less than half of the countries (49.47%), respondents, on average, indicate that tax complexity has substantially increased in the last two years.

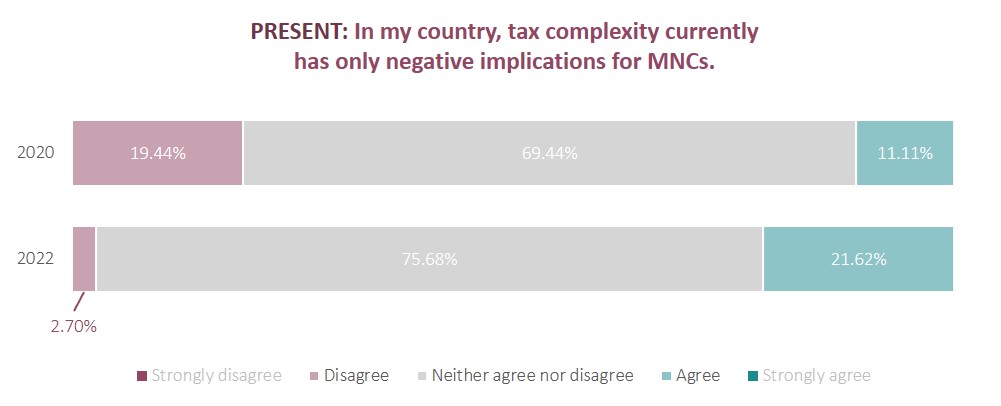

On average, the respondents of most countries do not agree that tax complexity has only negative implications for MNCs. This shows that complexity is not negative per se.

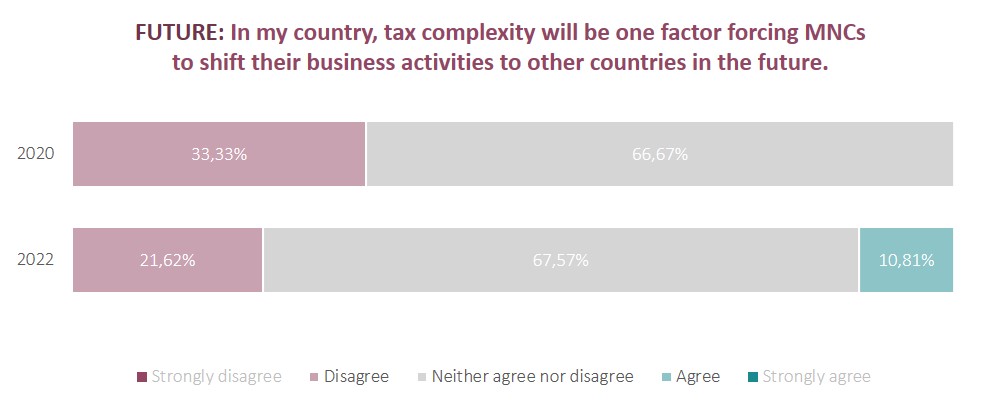

The respondents in the majority of countries, on average, do not agree with the statement that tax complexity will force MNCs to shift their business activities to other countries. However, respondents in almost 15% of the countries do, on average, agree with this statement. Although this finding seems to be somewhat ambiguous, it still implies a call for action for policy makers to reduce tax complexity.

Individual responses are aggregated at country level. If the resulting country-level aggregate of responses lies between two response categories, it is attributed to the nearest category.

Tax Code Complexity

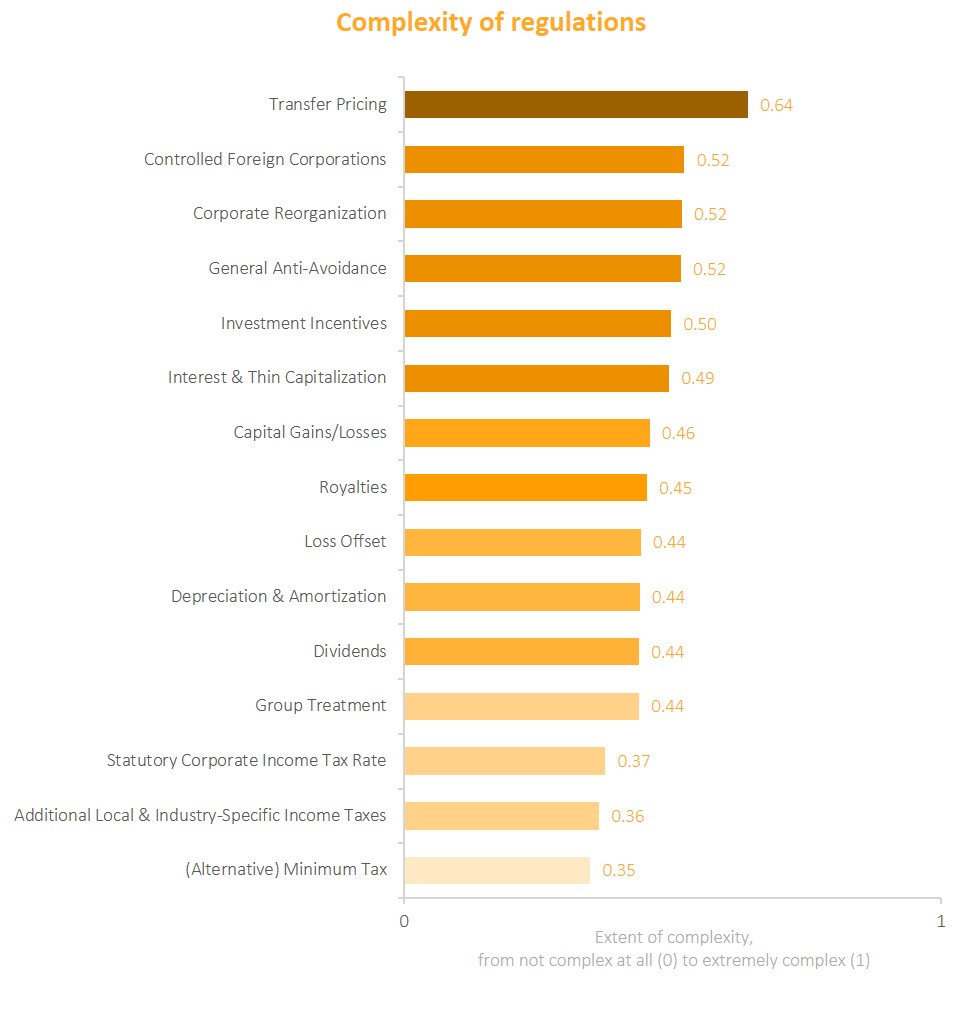

Transfer pricing is perceived as the most complex tax regulation

Of the 15 tax regulations examined, transfer pricing is perceived as the most complex: for 65 of 95 countries, it was ranked as most complex. This is in line with transfer pricing being one of the main concerns of the OECD’s BEPS project. Moreover, it is currently one of the core features of the OECD’s Pillar 1, which shall serve to fight tax avoidance and enhance the fair allocation of tax revenues across countries. However, Pillar 1 also has the potential to further increase tax complexity of transfer pricing. The aim of tackling tax avoidance also applies to general anti-avoidance regulations as well as to controlled foreign corporation rules, which, together with transfer pricing, are among the most complex regulations.

Individual responses are aggregated at country level. The analysis only includes countries in which the respective regulation is considered existent.

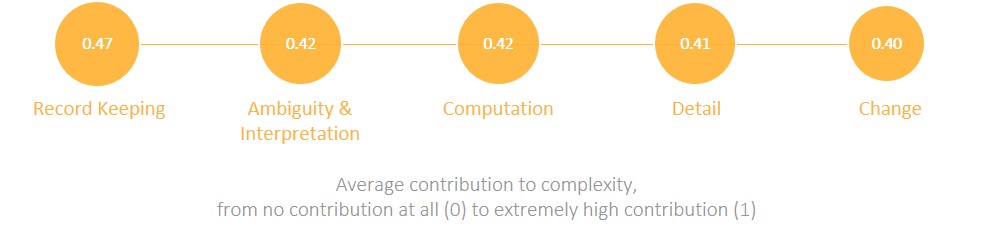

Record keeping contributes most to complex tax regulations

On average, record keeping is perceived as the driver which contributes most to the complexity of tax regulations. Hence, keeping many records and documents to substantiate tax claims or to complete tax returns seems to be the greatest challenge in the application of tax regulations.

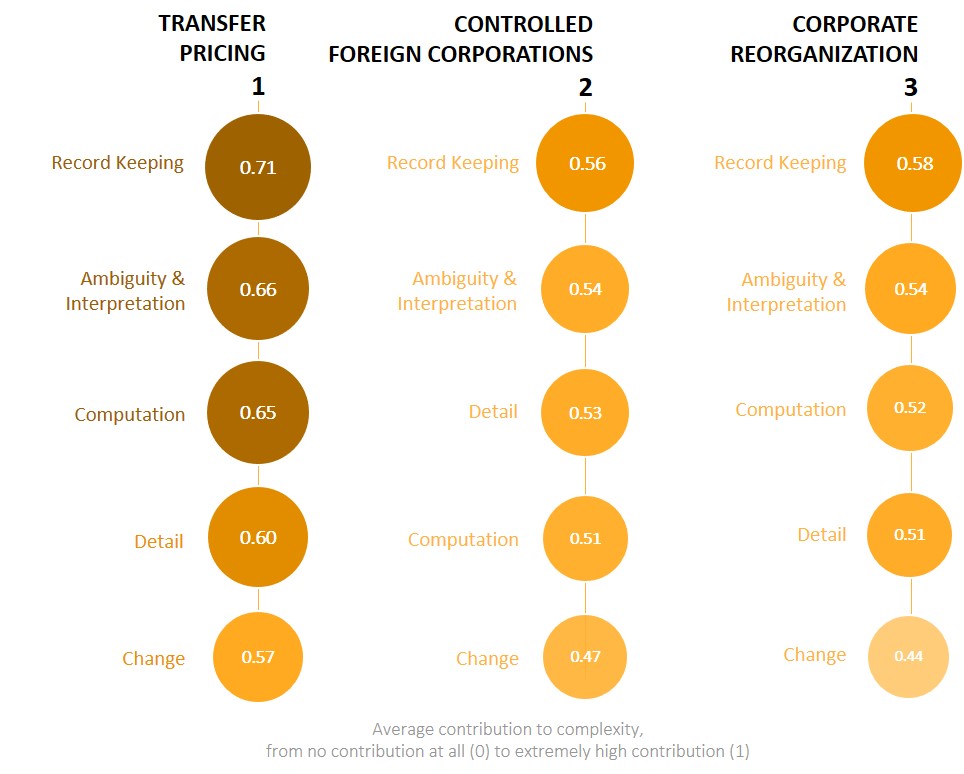

However, individual regulations may be affected differently by the drivers of tax complexity, which is outlined by a closer look at the three most complex regulations: The main driver of the complexity of regulations on transfer pricing, controlled foreign corporations and corporate reorganization is record keeping. The complexity of those regulations is least driven by change.

Individual responses are aggregated at country level. The analysis only includes countries in which the respective regulation is considered existent.

Tax Framework Complexity

Tax Audits

Tax audits describe the examination of the tax returns by the tax authority as well as the extent to which they can be anticipated and prepared by MNCs.

In 60 of 95 countries, lacking or only limited disclosure of selection criteria for tax audit targets is, on average, perceived as the most serious problem in the anticipation of tax audits. This lack of transparency in selection criteria seems to challenge MNCs.

Rules or written guidelines that clearly outline the tax audit process exist in about three quarters of countries. Even though this suggests uniformity in the performance of tax officers, in 70 of 95 countries the inconsistency of tax officers’ decisions is perceived as the most serious problem in the tax audit process. This contrast may exist because tax audit guidelines often leave discretion to tax officers, which leads to varying decisions on similar cases from officer to officer or even inconsistency with the same officer.

Individual responses are aggregated at country level.

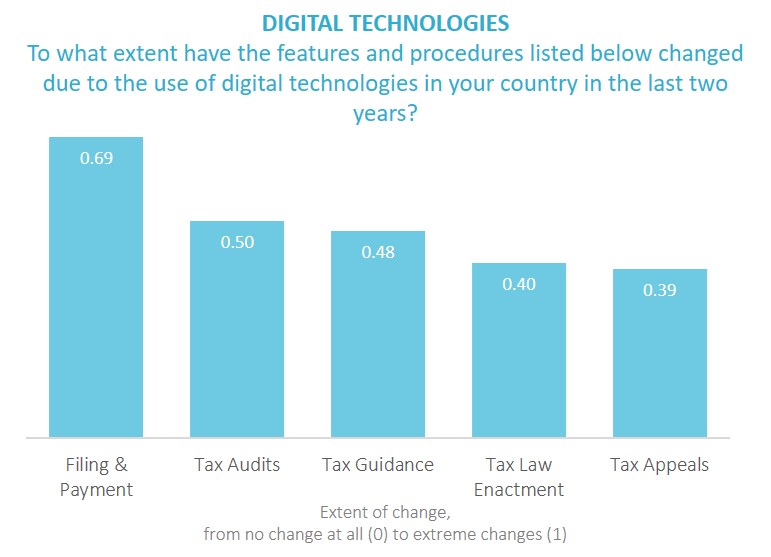

Influence of Digital Technologies in 2022

Digitalization is fundamentally reshaping many legislative and administrative processes world-wide. Nevertheless, not all processes are affected in the same way. Therefore, we included a new question in our 2020 and 2022 survey about the extent to which digital technologies have changed the different processes and feature of the tax framework.

In 77 of 95 countries, filing and payment has changed the most due to the use of digital technologies in the last two years. For example, both the remittance of tax payments and the transmission of tax returns are rather standardized procedures in which digital technologies can be introduced comparably easily.

The dimension of the tax framework least affected by digital technologies is appeals. Despite efforts by the OECD to make appeals, and more specifically MAPs, more efficient, the high level of perceived complexity of appeals indicates that there is still room for improvement in the digital access to appeal procedures.

Individual responses are aggregated at country level.

OECD Countries in 2020 and 2022

The Organisation for Economic Co-operation and Development (OECD) is one of the main players in the international tax environment. In the following section, we therefore present the major changes in tax complexity in 2022 as compared to our 2020 Global MNC Tax Complexity Survey for the OECD member countries. The 38 member countries are among the most developed countries worldwide and almost exclusively represent high-income economies.

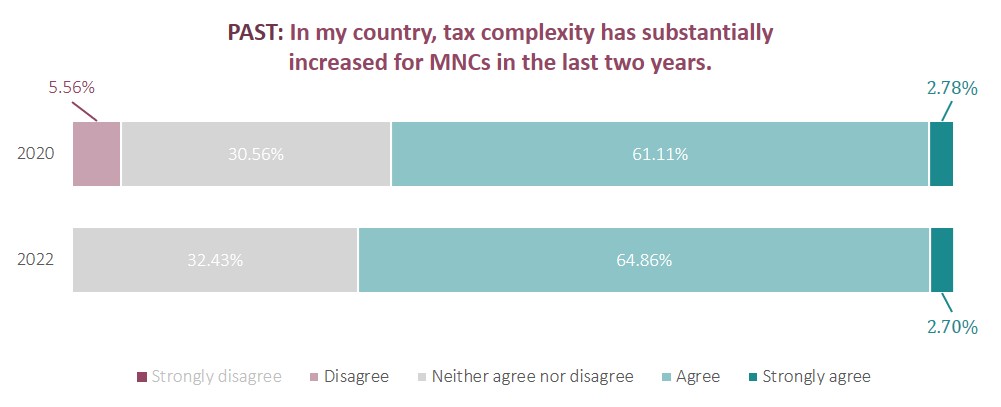

In 2022, respondents in the vast majority of OECD countries, on average, agree or strongly agree with the statement that tax complexity has substantially increased within the last two years. This majority of 67.56% of respondents who agree or strongly agree to the statement above in 2022 is almost identical to the 2020’s share of respondents (63.89%). In no OECD country respondents disagree with the statement that tax complexity has substantially increased for MNCs in the last two years in 2022. This constitutes a decrease compared to 2020 (5.56%).

Our results indicate that respondents in more OECD countries, on average, agree that tax complexity has substantially increased in the last two years (see above). In addition, we observe that tax complexity has an increasing impact on MNCs’ business location decisions. Respondents in OECD countries in 2022, on average, disagree less (11.71 percentage points) with the statement that tax complexity will be one factor forcing MNCs to relocate their business activities to other countries. In fact, 10.81% of respondents from an OECD country agree with the statement that tax complexity is a factor driving MNCs to relocate their business activities (vs. 0% in 2020).

Individual responses are aggregated at country level. If the country response lies between two response categories, it is attributed to the nearest category.

The OECD countries are: Australia, Austria, Belgium, Canada, Chile, Colombia, Costa Rica*, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland*, Ireland, Israel, Italy, Japan, Korea (South), Latvia, Lithuania, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States.

*Please note that in the subsequent analysis, Iceland is not included in the sample for lack of data. Also, Costa Rica has only become an OECD member in 2021 and is therefore not included in the 2020 dataset. This leaves us with a sample of 36 OECD countries in 2020 and 37 OECD countries in 2022.

Why do our results matter?

In recent years, MNCs have faced increasing levels of tax complexity, making it an important aspect to consider. We suppose this development is shaped by, among other things, multiple trends in global tax systems, each of them with potentially ambivalent effects on tax complexity. We analyze the level and change of tax complexity in and across countries and over time. We also measure what drives tax complexity. Our data and analyses provide a unique basis for future studies on the role of tax complexity for compliance and firms’ investment decisions.

Our results are particularly interesting for policymakers, practitioners and researchers. With our data and our analyses, we want to enhance the understanding of tax complexity in and across countries.

Tax Complexity Website

Based on our survey results, we construct the Tax Complexity Index that measures countries’ tax complexity in several dimensions. We include those countries for which we obtained sufficient responses to qualify for the index. For methodological details, see Hoppe, Schanz, Sturm, and Sureth-Sloane (2023).

Data for the 2016, 2018, 2020, and 2022 Tax Complexity Index is available through our interactive website. This website allows you to learn more about tax complexity and facilitate comparative analyses of different countries over time. Additionally, our website enables you to create your own index based on your specific interests and priorities in various dimensions of the tax code and the tax framework.

We are and have been dedicated to the philosophy of open science from the very beginning of our Global MNC Tax Complexity Survey. The website allows you to learn more about tax complexity in many countries, to compare countries and track the development of tax complexity over time. It also offers you plenty of possibilities to make your own index.

We also very much appreciate any feedback and you are welcome to share the website with any interested parties.

Acknowledgements

We thank the following participants for supporting us and taking part in the 2022 Global MNC Tax Complexity Survey!

The researchers

The following researchers from LMU Munich and Paderborn University were involved in establishing and conducting the 2022 survey and analyzing the data.

Related Publications

2022 Global MNC Tax Complexity Survey

The Tax Complexity Index – A survey-based country measure of tax code and framework complexity

2020 Global MNC Tax Complexity Survey

No. 5: The Tax Complexity Index – A survey-based country measure of tax code and framework complexity

2018 Global MNC Tax Complexity Survey

No. 20: Tax complexity in Canada: A comparative perspective

Tax complexity in Australia – A survey-based comparison to the OECD average

No. 13: The relation between tax complexity and foreign direct investments: Evidence across countries

Tax complexity for multinational corporations in South Africa – Evidence from a global survey

Steuerkomplexität im Vergleich zwischen Deutschland und Österreich – Eine Analyse des Status quo

Related Blog Posts

Simplification of the global minimum tax: a simple yet viable solution

The introduction of the global minimum tax (GloBE, also known as Pillar Two) leads to criticism by affected firms. The solution: firms should be exempted from filing a GloBE declaration for those countries where it is likely that they easily meet the agreed minimum tax rate via.

Read moreThe Tax Complexity Index – An innovative measure to analyze tax complexity across countries

Recently, the relevance of tax complexity has increased significantly. This is a potential threat for the economy and society since the negative consequences of complex tax systems can jeopardize economic prosperity and encourage undesired tax planning as well as tax avoidance.

Read moreComparing Tax Complexity: Germany vs. Austria

An infographic summarizes the main differences and similarities in tax complexity between Germany and Austria.

Read more