Targeted Transparency: Nudging Firms towards changing their Business Activities in Socially Desirable Ways

Nudging is a popular concept from behavioral economics that has also found its way into other (research) fields. With nudging positive reinforcement and indirect suggestions are used as ways to influence the behavior and decision making of groups and individuals. A classic example is that in order to help your employees make healthy food choices you could replace the jar with sweets at the reception desk with a bowl of fruit, therewith giving the employees a small push, a nudge, in the right (healthy) direction. As such, nudging is said to be an alternative way to achieve compliance, contrasting formal methods such as legislation. However, nudging and formal regulations can also go hand in hand. Katharina Hombach and Thorsten Sellhorn published a review on ‘targeted transparency’, which is transparency regulation aimed at nudging firms towards changing their business activities in socially desirable ways. They developed a framework that lays out the necessary conditions under which targeted transparency regulation can be effective and reviewed the emerging empirical evidence. They discuss their framework and main findings below.

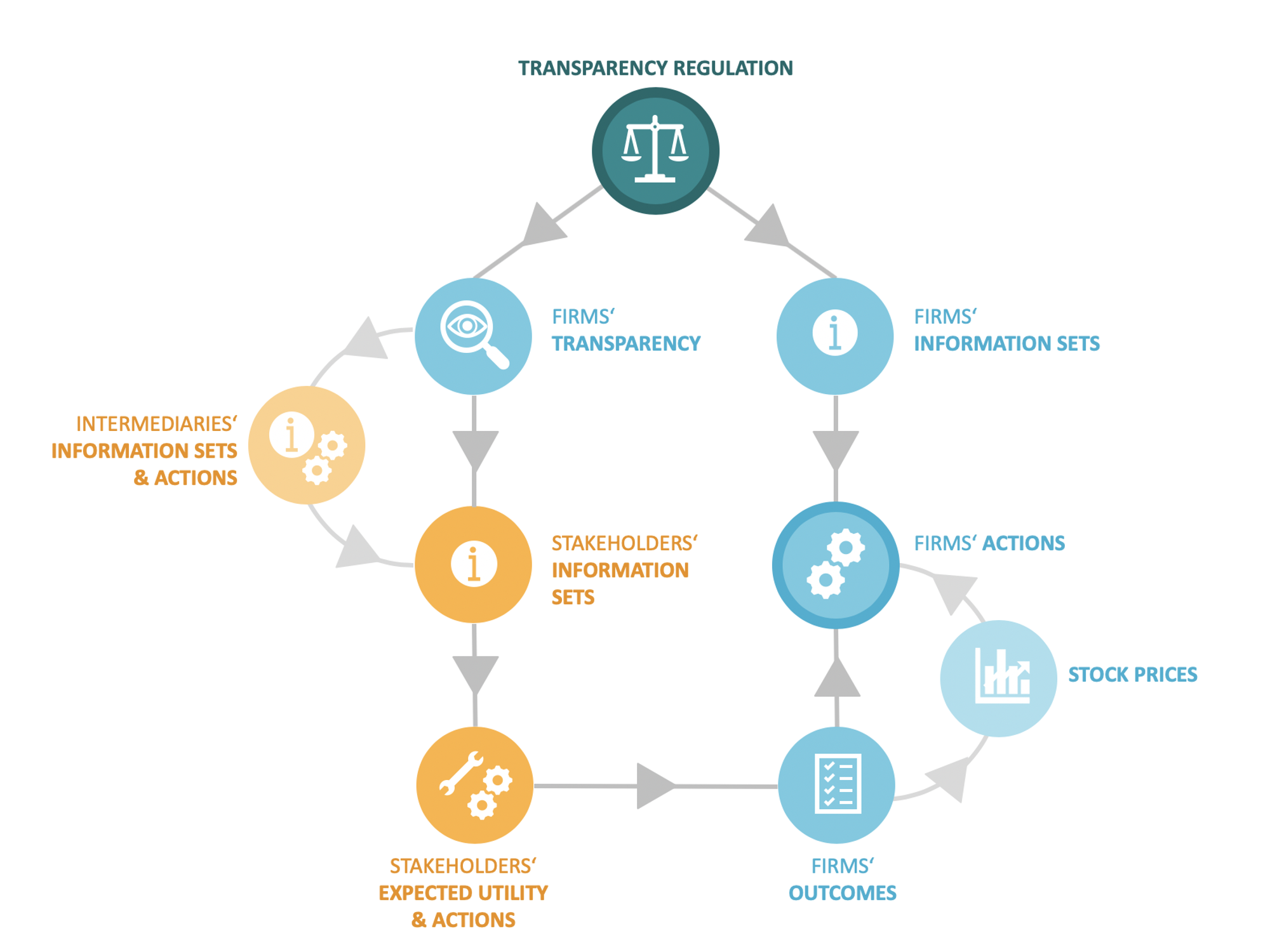

Targeted transparency regulation’s objectives extend beyond pricing. These regulations force companies or agencies to disclose information in standardized formats to reduce specific risks, account for negative externalities, or to improve provision of public goods and services. Mandatory nutrition labeling of food products, intended to reduce unhealthy eating habits and therewith potentially large health costs to individuals and society at large, is an example of such a policy. However, targeted transparency may also address environmental, equality and various other issues. We looked at a specific type of targeted transparency: targeted transparency implemented by securities regulators. These mandated disclosures are aimed not only at providing decision-useful information to investors, but also at mobilizing pressure from a broad range of potential users, including consumers, employees, citizens, the media as well as NGOs and other advocacy groups. Examples include CSR reporting, country-by-country reporting of oil and gas firms’ payments to governments, and disclosure of the gender composition of corporate boards. We specifically looked at studies on recent CSR reporting requirements in the E.U. and Specialized Disclosure regulation in the US. Although these disclosure requirements are implemented via corporate disclosure regulation, they are primarily aimed at fostering public policy objectives that are at least partly unrelated to securities regulators’ traditional objectives and mandates. For example, the EU’s CSR Directive intends to foster outcomes related to firms’ environmental impact, social and employee aspects, human-rights and anti-corruption measures, and board diversity, all elements that do not directly relate to pricing and the capital market. We developed a framework showing that in order to create an effective nudge, targeted transparency regulation needs to set off a causal chain that links the disclosure requirement to the targeted corporate action.

Necessary conditions for effective targeted transparency regulation: a framework

We explored the mechanisms through which targeted transparency implemented via corporate disclosure regulation can lead to changes in a firm’s actions. More specifically, we present a framework for the necessary conditions under which targeted transparency regulation can be effective. The figure below illustrates this possible causal chain. Starting at the top, we show that the first step is that the targeted transparency regulation has to affect the firm’s actual transparency, meaning increasing the quantity and quality of publicly disclosed information.

Related Content

Evidence-informed accounting standard setting – lessons from corona

How can researchers and standard setters address validity challenges as they work towards more evidence-informed standard setting?

Read more

Responses