Warum beteiligen sich nicht alle Unternehmen an der Steuervermeidung?

Höhere Cashflows nach Steuern und ein höherer Unternehmenswert: die Vorteile der rechtlichen Steuervermeidung. Die Beteiligung an Steuerplanungsaktivitäten, die darauf abzielen, Steuern auf legalem Wege zu vermeiden, scheint daher eine vernünftige Strategie für jedes Unternehmen zu sein. Empirische Studien zeigen jedoch, dass nicht alle Unternehmen in gleicher Weise an der Steuervermeidung beteiligt sind. Während es in der aktuellen Literatur schwierig ist, die große Variationsbreite der Steuervermeidung in den Unternehmen zu erklären, haben Martin Jacob und Anna Rohlfing-Bastian zusammen mit Kai Sandner ein formales Modell entwickelt, das es schafft, einen Teil dieser Variation zu erklären.

Entgegen der weit verbreiteten Annahme zeigen empirische Studien, dass nicht alle Unternehmen Steuervermeidung betreiben, obwohl die monetären Vorteile legaler Steuerplanungsaktivitäten nicht geleugnet werden können. Einige Unternehmen zahlen sogar Steuersätze, die über dem gesetzlichen Steuersatz liegen. Warum ist es also für Unternehmen nicht gleichermaßen attraktiv Steuerplanung zu betreiben? Das ist eine Frage, die viele Forscher* mit Interesse verfolgt haben. Mehrere empirische Studien dokumentieren das sogenannte „Under-Sheltering Puzzle“, das sich auf die rätselhafte Beobachtung bezieht, dass nicht alle Unternehmen Steuervermeidung betreiben. Allerdings fällt es den Forschern schwer, diese Querschnittsunterschiede umfassend zu erklären. Wir haben ein Modell entwickelt, das zur Erklärung dieses Rätsels beiträgt: Es bietet einen theoretischen Rahmen, um unternehmensübergreifende Unterschiede in der Steuerplanung zu testen und zu erklären.

Unser Modell

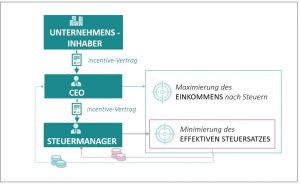

Unser Modell konzentriert sich auf die strategischen Interaktionen zwischen drei Akteuren: dem Unternehmensinhaber, dem CEO und dem Steuermanager (der dem CEO unterstellt ist). Wir gehen davon aus, dass die Interessen dieser drei Akteure voneinander abweichen können. Während sich das Interesse des Unternehmensinhabers auf den Erfolg seines Unternehmens konzentriert, wird angenommen, dass sich der CEO und der Steuermanager opportunistisch verhalten und dadurch nur ihren individuellen Nutzen maximieren. Um den CEO und den Steuermanager zu motivieren, im Interesse des Unternehmenseigentümers zu handeln – besser bekannt als Moral Hazard – muss ein wirksames Anreizsystem geschaffen werden.

Dementsprechend bietet der Unternehmensinhaber in unserem Modell dem CEO einen Incentive-Vertrag an, der für seine Bemühungen um die Maximierung des Nach-Steuer-Ergebnisses belohnt wird. Um erfolgreich zu sein, muss der CEO nicht nur sicherstellen, dass der Gewinn vor Steuern so hoch wie möglich ist, sondern auch, dass der effektive Steuersatz (ETR) entsprechend niedrig ist. Für Letzteres ist der Steuermanager verantwortlich. Aus diesem Grund bietet der CEO seinerseits dem Steuermanager einen Incentive-Vertrag an, der auf der Grundlage des von ihm kontrollierten Ergebnisses, nämlich des ETR, vergütet wird. Beide verdienen höhere Löhne, wenn sie in ihren Leistungen erfolgreich sind.

Abwägung von Kosten und Nutzen

Auf der Grundlage unseres Modells kommen wir zu dem Schluss, dass die Entscheidung eines Unternehmens, sich an der Steuerplanung zu beteiligen, auf der Abwägung der erwarteten Vorteile und der mit diesen Aktivitäten verbundenen Kosten beruht. Insbesondere hängt die Entscheidung für eine Steuerplanung von der Interaktion zwischen den folgenden Faktoren ab: 1) der Höhe der monetären Incentives, die gezahlt werden müssen, um den CEO und den Steuermanager zu motivieren, hohe Anstrengungen bei der Ertragsgenerierung und Steuerplanung zu unternehmen (Incentive-Kosten), 2) dem Potenzial zur Ertragssteigerung und 3) den Kosten auf Unternehmensebene, wie z.B. einem großen Reputationsschaden (Reputationskosten) oder der ständigen Überwachung durch Regierungsbehörden (politische Kosten).

Um das Ergebnis unseres Modells zu veranschaulichen, haben wir das Modell auf zwei konkrete Fälle angewandt. Wir haben öffentliche mit privaten Unternehmen und Familienunternehmen mit Nicht-Familienunternehmen verglichen.

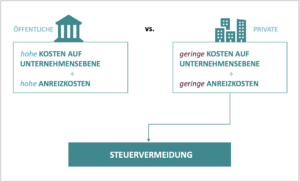

Öffentliche Unternehmen vs. Private Unternehmen

Wer ist anfälliger für aggressive Steuerplanung? Private oder öffentliche Unternehmen? Was würden Sie erwarten? Nach unserem Modell ist die Antwort ganz klar: Aufgrund verschiedener Faktoren sind private Unternehmen in der Regel eher zur Steuervermeidung bereit.

Zum Beispiel spielt ihre geringere Abhängigkeit von der Öffentlichkeit eine wichtige Rolle. Öffentliche Unternehmen stehen viel mehr im Blickpunkt der Öffentlichkeit als private, sie müssen eine beträchtliche Menge an Informationen offenlegen. Als solche bleiben ihre Steuerplanungsaktivitäten nicht unbemerkt. Eine zu aggressive Steuerplanung könnte daher leicht den Ruf des Unternehmens bei den Stakeholdern und in der Öffentlichkeit schädigen. Auch die Beziehung zwischen dem Unternehmen und den Steuerbehörden könnte darunter leiden, was die Möglichkeiten zur Steuervermeidung in Zukunft einschränken könnte. Dementsprechend ist eine aggressive Steuerplanung für öffentliche Unternehmen aufgrund der höheren Reputations- und politischen Kosten weniger attraktiv.

Und es gibt noch weitere Gründe: Bei privaten Unternehmen ist der Besitz tendenziell stärker konzentriert. Das bedeutet, dass diese Eigentümer mit größeren Beteiligungen stärkere Anreize haben, das Management genau zu überwachen, da ihr persönlicher Erfolg stark an den Unternehmenserfolg gekoppelt ist. Darüber hinaus gibt es eine größere Überschneidung von Eigentum und Management innerhalb der Privatunternehmen, was eine geringere Delegation bedeutet. In beiden Fällen muss der Eigentümer weniger finanzielle Anreize setzen, um den CEO zu ermutigen, die Motivation des Steuermanagers für die Steuerplanung zu erhöhen.

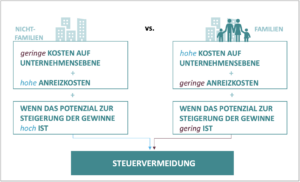

Nicht-Familienunternehmen vs. Familienunternehmen

Unser Vergleich von Familien- und Nicht-Familienunternehmen vermittelt ein etwas anderes Bild. Die Ergebnisse sind etwas zweideutig. Eines ist jedoch ganz klar: Innerhalb von Familienunternehmen ist eine negative Unternehmensreputation eng mit einer negativen persönlichen Reputation verbunden, da die Verantwortlichen oft engere Beziehungen zueinander und zur Firma haben. Aus diesem Grund vermeiden Familienunternehmen tendenziell Handlungen, die ihrem Ruf schaden könnten, wie zum Beispiel eine aggressive Steuerplanung. Sind Familienunternehmen daher generell weniger anfällig für Steuervermeidung als Nicht-Familienunternehmen?

Unser Modell zeigt: Es kommt darauf an, denn es gibt ein entscheidendes Gegengewicht zu diesen hohen Reputationskosten: die höhere Konzentration von Eigentum und die erhebliche Überschneidung von Eigentum und Management innerhalb von Familienunternehmen. Daher müssen Familienunternehmen in der Regel weniger Anreizkosten aufwenden, was wiederum ihre Wahrscheinlichkeit erhöht, sich an der Steuerplanung zu beteiligen.

Bis zu einem gewissen Grad gleichen sich beide Aspekte aus. Das Potenzial zur Ertragssteigerung wird zum Indikator auf der Skala. Es entscheidet darüber, ob die Skala zur einen oder anderen Seite wandert. Wenn das Potenzial gering ist, sind Familienunternehmen eher bereit, sich der Steuervermeidung zu widmen. Niedrigere Anreizkosten scheinen der treibende Faktor für diese Entscheidung zu sein. Sie machen eine aggressive Steuerplanung weniger kostspielig und daher für Familienunternehmen attraktiver. Wenn das Potenzial zur Ertragssteigerung hoch ist, kann die Gefahr eines Reputationsschadens den Vorteil geringerer Anreizkosten überwiegen. In diesem Fall sind Familienunternehmen weniger geneigt, sich an der Steuerplanung zu beteiligen, als im Falle eines geringen Potenzials zur Ertragssteigerung.

Auswirkungen

Unsere Ergebnisse sind wichtig für die Gesellschaft, um zu verstehen, dass nicht alle Unternehmen gleichermaßen anfällig für Steuerumgehung sind und warum nicht alle Unternehmen Steuern vermeiden. Da die Vermeidung von Unternehmenssteuern ein Thema ist, das ganz oben auf der Tagesordnung von politischen Entscheidungsträgern steht, z.B. der OECD und der G20, ist es für die Gesellschaft wichtig zu erkennen, welche Unternehmen von Änderungen der Regulierung stärker betroffen sind (diejenigen, die mit größerer Wahrscheinlichkeit Steuern vermeiden) und welche Unternehmen weniger von Anti-Steuervermeidungsregelungen betroffen sind (diejenigen, die zunächst weniger Steuern vermeiden). Wir freuen uns auf die zukünftige Arbeit, die unsere Modellprognosen mit den Daten verbindet, um ihre empirische Gültigkeit zu bewerten.

*In diesem Beitrag wird ausschließlich zum Zweck der besseren Lesbarkeit auf die geschlechtsspezifische Schreibweise verzichtet. Alle personenbezogenen Bezeichnungen sind somit geschlechtsneutral zu verstehen.

Lesen Sie die Publikation „Why do not all firms engage in tax avoidance?“ von Martin Jacob, Anna Rohlfing-Bastian und Kai Sandner, veröffentlicht in „Review of Managerial Science“: https://link.springer.com/article/10.1007/s11846-019-00346-3.

Zitation dieses Blogs:

Jacob, M., & Rohlfing-Bastian, A. (2020, Februar 11). Warum beteiligen sich nicht alle Unternehmen an der Steuervermeidung?, TRR 266 Accounting for Transparency Blog. https://www.accounting-for-transparency.de/de/warum-beteiligen-sich-nicht-alle-firmen-an-der-steuerumgehung/

More Information

In unserem Papier bauen wir auf der Idee auf, dass die Entscheidung über die Steuerplanung durch Moral Hazard beeinflusst wird. Um dies zu beweisen, haben wir ein Prinzipal-Agenten-Modell mit einem Prinzipal (Unternehemensinhaber) und zwei Agenten (CEO und Steuermanager) entwickelt. Wir entschieden uns für ein Standardmodell für verdeckte Aktionen mit beschränkter Haftung, bei dem wir hierarchische Vertragsverantwortlichkeiten einsetzen.

In der Prinzipal-Agententheorie beschreibt Moral Hazard die Möglichkeit eines Agenten, der im Namen des Auftraggebers handelt, seinen Informationsvorteil zu seinen Gunsten und damit zum Nachteil des Auftraggebers auszunutzen. Durch Gewinnbeteiligung wird das Handeln gegen die Interessen des Vertragspartners unattraktiv.

Lesen Sie mehr zu diesem Thema

Fakt oder Fake News: Zahlen deutsche Unternehmen nur zwei Drittel des regulären Steuersatzes?

Huber und Maiterth untersuchten Janskys Studie und kamen zu dem Schluss, dass der Unterschied zwischen dem regulären Steuersatz und dem effektiven Steuersatz vernachlässigbar ist.

Weiterlesen

Antworten