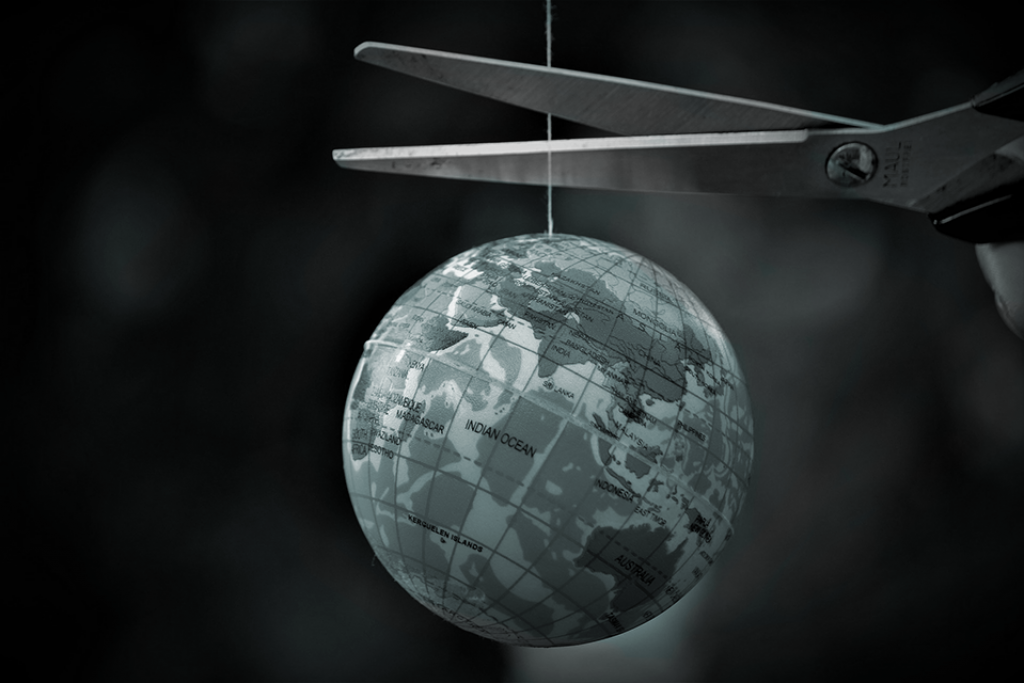

Beyond borders – increased uncertainty about future tax enforcement leads to reduced investments

In 2013, the European Commission started a wave of investigating tax arrangements between several EU countries, including some tax havens (e.g., Belgium, Ireland, Luxembourg, and the Netherlands) and multinational enterprises (MNEs), especially U.S. firms. Tax arrangements that were agreed upon years ago suddenly moved into the focus of the European Commission. The scope of investigations of these so-called “state aid cases” was unprecedented at that time and increased uncertainty with regards to future tax enforcement. What economic effects did these actions have? Does the threat of potential stricter tax enforcement lead to a change in investment activity? Martin Jacob and his co-authors address these questions in their publication in “The Accounting Review” and offer valuable insights for regulators, like the European Commission, with respect to their actions.

Due to the growing globalization many countries have offered tax incentives to attract corporate investment. This has allegedly resulted in some firms, especially high-profile U.S. MNEs like Amazon, Apple, McDonalds, or Starbucks, receiving preferential tax treatment by some European countries. Such tax rulings supposedly reduced the tax burden for recipient MNEs in ways that were not available to other MNEs. As a result, this might have influenced certain MNEs’ investment decisions in the targeted countries. While this has been proven favorable for some MNEs for some time, the European Commission’s investigations caused increased uncertainty about how this will be treated in the future. One example is the initial decision (which has been recently reversed, however, by the European Court) that required Apple to pay $14.4 billion in back taxes and interest to Ireland.

Reduction of U.S. firms’ investment in affected countries

We find that from after the initiation of the European Commission’s investigations, increased uncertainty about future tax enforcement led to a significant decline in investment of U.S. MNEs’ subsidiaries in targeted state aid countries. Moreover, our results similarly show a significant decline in firm input purchases from targeted countries as well as a decline in aggregate investment of U.S. firms flowing to those countries. For U.S. MNEs’ subsidiary investments the effect is particularly clear: fixed assets of these companies declined by 1.7% of total assets, or $7.6 million per subsidiary. Overall, that implies that U.S. firms cut investments in the affected EU countries and as a result the affected governments lost important investments and real FDI (Foreign direct investment) flows.

Impact and relevance of the research

As governments around the world are confronted with the challenges of enforcing tax laws in an increasingly global economy, we highlight the increasing complexity of a global tax environment, where more actors can be involved in tax regulation and enforcement than on a national level. Our findings provide valuable insights for policymakers about their actions: The consequence of the European Commission’s investigations and thus the increased uncertainty over tax enforcement resulted in a reduction of investments and an offshoring of capital. In a nutshell: firms refrain from investing in Europe.

To cite this blog:

Fox, Z., Jacob, M., Wilde, J., & Wilson, R. J. (2023, February 8). Beyond borders – increased uncertainty about future tax enforcement leads to reduced investments, TRR 266 Accounting for Transparency Blog. https://www.accounting-for-transparency.de/blog/beyond-borders-increased-uncertainty-about-future-tax-enforcement-leads-to-reduced-investments

Responses