Wealth tax: curse or blessing?

Demanded by some, criticized by others: the implementation of a wealth tax is a highly discussed topic right now, especially a few months before the federal election in Germany. While its supporters regard it as an effective tool to finance Corona debt and enable a fairer distribution of wealth, critics warn of its negative economic effects. The TRR 266 researchers Ralf Maiterth and Caren Sureth-Sloane took a closer look at the economic effects of an annual wealth tax and investigated how it affects firms, investors and real estate owners in a low interest rate environment like the one Germany and many other countries are currently facing.

The day of the federal election is fast approaching and the election campaign is already in full swing. The first party programs have been published since May. Some of them bring an old acquaintance back to the scene: the wealth tax, which was abolished in Germany in 1996. The SPD, the Greens and the Left Party want to reinstate this tax. The main argument in favor of a wealth tax: fairer distribution of wealth and financial burdens. A survey by ARD television (2019) shows: 72 percent of the respondents would support the implementation of such a tax. Even parts of the scientific community are increasingly in favor of a wealth tax since wealth inequality has increased significantly over time. Moreover, the gap that is opening up here is much wider than the gap between low and top earners.

Opponents of a wealth tax, on the other hand, fear negative economic effects. In particular, they warn of depletion of assets and economic impairment. This is why we took a closer look at the economic effects of a wealth tax. We focused on an aspect that has not been adequately addressed until now: The effect of an annual wealth tax in a low interest rate environment many economies are currently facing. What is the additional tax burden of a wealth tax and how does it affect the net return on real investments?

High tax burden for firms

We have calculated the marginal tax burden of firms for different scenarios and for the tax rates (1%, 2% and 3%) mentioned in the current election programs. We did not focus on wealth tax only. We also took the interaction of wealth tax and income taxes into account. The calculations are based on the assumption of a partnership with a 45% income tax rate and a trade tax multiplier of 400% (effective trade tax rate of approx. 14%). All scenarios paint a similar picture. The total tax burden resulting from income and wealth tax is significant, especially at higher taxation rates (2% and 5%) and low returns, which are the standard in a low interest rate environment. In some cases, the earnings generated are not high enough to pay the taxes. Instead, the total assets must be used for this purpose. This applies in particular to the highest wealth tax rate: even with high returns, almost all earnings are taxed away when implementing a 5% wealth tax.

High wealth tax rates reduce total assets

Firms: wealth tax threatens to erode total assets with low rates of return

For a net return to remain at all, the pre-tax return would have to be 9.4%, 3.8% or 1.9% given a tax rate of 5%, 2% and 1%, respectively. Considering the current period of low interest rates, these are significant amounts that many firms would not be able to generate. If the ECB's target inflation rate of 2% is considered, the required pre-tax returns would increase significantly to 13.3% (at 5%), 7.5% (at 2%) and 5.6% (at 1%).

This means: especially in times of economic crises with low rate of return, e.g., below 5%, a wealth tax prevents firms from maintaining and building real equity capital. This in turn limits the scope for investments. To mitigate these negative economic consequences, the implementation of a wealth tax would require the consideration of excluding business assets from this tax, at least partially. However, since most of the largest assets are tied up in firms, this would generate significantly lower tax revenues than originally envisaged by the parties.

Negative real interest rate even with low tax rates and high

pre-tax rates of return

Stocks: negative net rates of return at high tax rates

Since fixed-interest bonds such as government bonds have been yielding low rates of return for a while now, stocks are becoming increasingly popular. That is why we examined whether investing in stocks is still rewarding in a low-interest environment after implementing a wealth tax. We analyzed how high the remaining cash flow from an equally weighted DAX 30 portfolio would be – and whether the after-tax returns would be high enough to bear the annual tax burden. The results are striking: only a 1% wealth tax would leave a small after-tax dividend return. For the two higher tax rates, additional funds would have to be raised from other sources to pay the taxes. As far as earnings returns are concerned the prospects are marginally brighter. At least with a 1% and 2% wealth tax, a net rate of return – albeit low – would remain. With a 5% tax rate, on the other hand, there would be a negative net rate of return and the investment would incur losses.

Negative net dividend rates of return with high wealth tax rates

Real estate: owners have to raise additional money to pay tax debt

A property tax would also be a burden for real estate owners. Even with a low wealth tax rate of only 1%, net rents would decrease significantly to amounts between 1.21 euros/sqm and 2.13 euros/sqm – depending on the region. If one considers that administrative costs and maintenance expenses still have to be borne by this revenue, it becomes clear that almost no net rental income would remain. With property tax rates of 2% and 5%, property owners would even have to raise additional money to be able to bear the tax burden in addition to these costs. Modernization measures would have to be financed from other sources.

Low net rental income even with low tax rates

Fixed-interest bonds: hardly any or even negative real interest rates

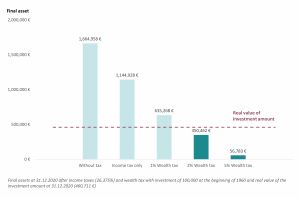

We also examined the long-term effects of a wealth tax – using the example of fixed-interest bonds – and calculated the (fictitious) net returns in all three wealth tax scenarios since 1960. We assume that interest revenue would not only be subject to the wealth tax but also – according to current law – to the withholding tax (25% plus solidarity surcharge). The results show: even with the lowest wealth tax rate (1%), the final assets from an investment would be noticeably lower than without this tax. If an inflation rate of 2% is considered, in most cases not even a positive real return on the capital invested would remain. In these cases, the real capital would shrink over time. With a 5% tax rate, for example, there are only approx. 12% of the capital invested remaining. Even if the investment horizon is shortened to 20 years, the tax effects are still pronounced.

Final assets: No positive real return at tax rates of 2% and 5%

Wealth tax: a burden on the economy and consumers

A wealth tax in times of low interest rates would place a heavy burden on many firms, investors and real estate owners. In some cases, there is even a threat of asset depletion and a partial loss of the capital invested. Wealth taxation that does not even allow real capital to be preserved does not seem to be conducive to economic development and Germany as a business location. Especially since a wealth tax still has to be paid in sustained periods of loss, which might exacerbate economic crises. Moreover, conservative forms of investment are not rewarding any more. This in turn creates incentives to invest in more lucrative but riskier forms of investment – making real estate and stock market bubbles more likely. In addition, most of the countries in Europe and around the world do not levy a wealth tax. Thus, the implementation of a wealth tax in Germany would lead to a burden on domestic investments and contribute to an increasing shift of book and also real capital abroad. Furthermore, at least a part of the tax burden would likely be passed on to consumers, employees and tenants. Finally, it would not only be the wealthy who would foot the bill.

To cite this blog:

Maiterth, R., Sureth-Sloane, C. (2021, August 16). Wealth Tax: Curse or Blessing?, TRR 266 Accounting for Transparency Blog. https://www.accounting-for-transparency.de/blog/wealth-tax-curse-or-blessing/

More Information

We looked at marginal tax burdens of an annual wealth tax to illustrate the effects of a wealth tax and to be able to make valid statements regardless of the respective wealth level. We do not go into greater detail on how the taxation of corporations and their shareholders is structured. Instead, we always assume a wealth tax of x%, which in total affects corporations and their shareholders in the same amount. We also assume that the wealth tax cannot be deducted from the income tax base and cannot be credited against income tax, as was the case with the wealth tax that existed until 1996 in Germany and in a draft law on its reintroduction (VStG-E 2014) in the German states of Rhineland-Palatinate, Baden-Württemberg, Hamburg and North Rhine-Westphalia.

Related content

Fact or fake news: Do German corporations pay only two thirds of the regular tax rate?

Huber and Maiterth scrutinized Jansky’s study, and conclude that the difference between the regular tax rate and effective tax rate is, in fact, negligible.

Read more(Mis)Perception of income tax burden

Do you know what the income tax burden on a gross annual salary of €10,000, €35,000, €100,000 or €500,000 is? Or what it is on your own salary?

Read more

Responses